In early June, European Union countries approved the sixth package of sanctions against Russia. It also included an embargo on imports of Russian oil and petroleum products by sea. All EU countries, except those for which an exception was made, will have to give up imports of Russian oil within six months of the approval of the package, and imports of petroleum products within eight months. Meanwhile, China increased its imports of Russian oil by 55% compared to the previous year, making Russia the largest supplier of oil to China. Now Russia is redirecting its oil trade flows and wants to use the export opportunities of its Caspian ports. As a result, due higher oil prices, Russia is earning on the sanctions rather than losing, at least if you count in currencies rather than rubles.

Content

Rerouting trade flows

Covering tracks

A breach in the sanctions

Budget Losses

Delayed effect

Last year, EU countries accounted for more than half of Russia's oil exports, so the supply ban seems troublesome for both Russia and Western countries. But the oil trading market is a rapidly adapting system. This is partly due to the physical properties of the commodity: it is easier to transport oil than gas, and if the price situation is convenient, it can be delivered anywhere in the world.

Until recently this statement was true for Russian oil as well. The only question was the price and its quality indicators. But with the beginning of the embargo on oil imports from Russia, a new variable - toxicity - was added to the equation that the trader has to solve when selling.

Rerouting trade flows

The global market (and Russian companies in particular) has already adapted to the new conditions. First of all, trade flows are changing.

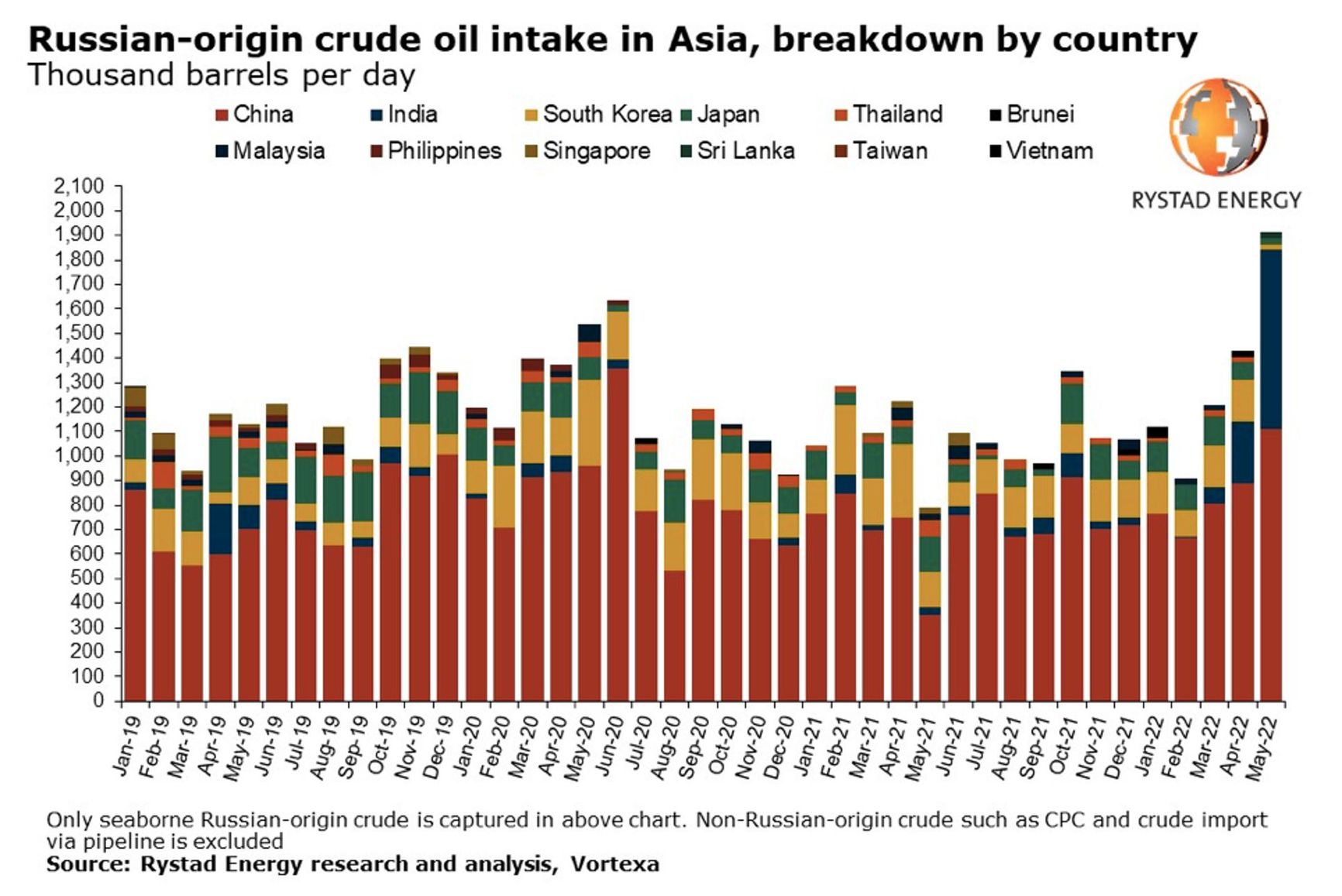

Germany and Poland continue to buy oil via the Druzhba pipeline, while sea shipments of Urals crude still go to European ports but their share has been decreasing month over month. According to Rystad Energy, Russian oil imports to Europe decreased by 554,000 bpd between March and May compared to January-February. Meanwhile, imports by Asian refineries (including China) increased by 503,000 bpd.

The global market has already adapted to the new conditions. First of all, trade flows are changing

Since the beginning of the war, over the period from March to May imports of Urals crude oil increased by 347% in Asia compared to 2021, by 658% in India, and by 205% in China, making Russia the largest supplier of oil to China.

However, we can see that the first months of relatively smooth unhindered trade of Russian oil in Asia have come to an end, and domestic companies still have to fight for their share of the new market. Saudi Arabia and Iran, for whom China and India are the key buyers of the crude, were naturally concerned about the emergence of large volumes of cheap Urals and decided to reduce the prices of their grades for the Asian buyers as well. As a result, the purchases of Urals by China and India decreased noticeably this month.

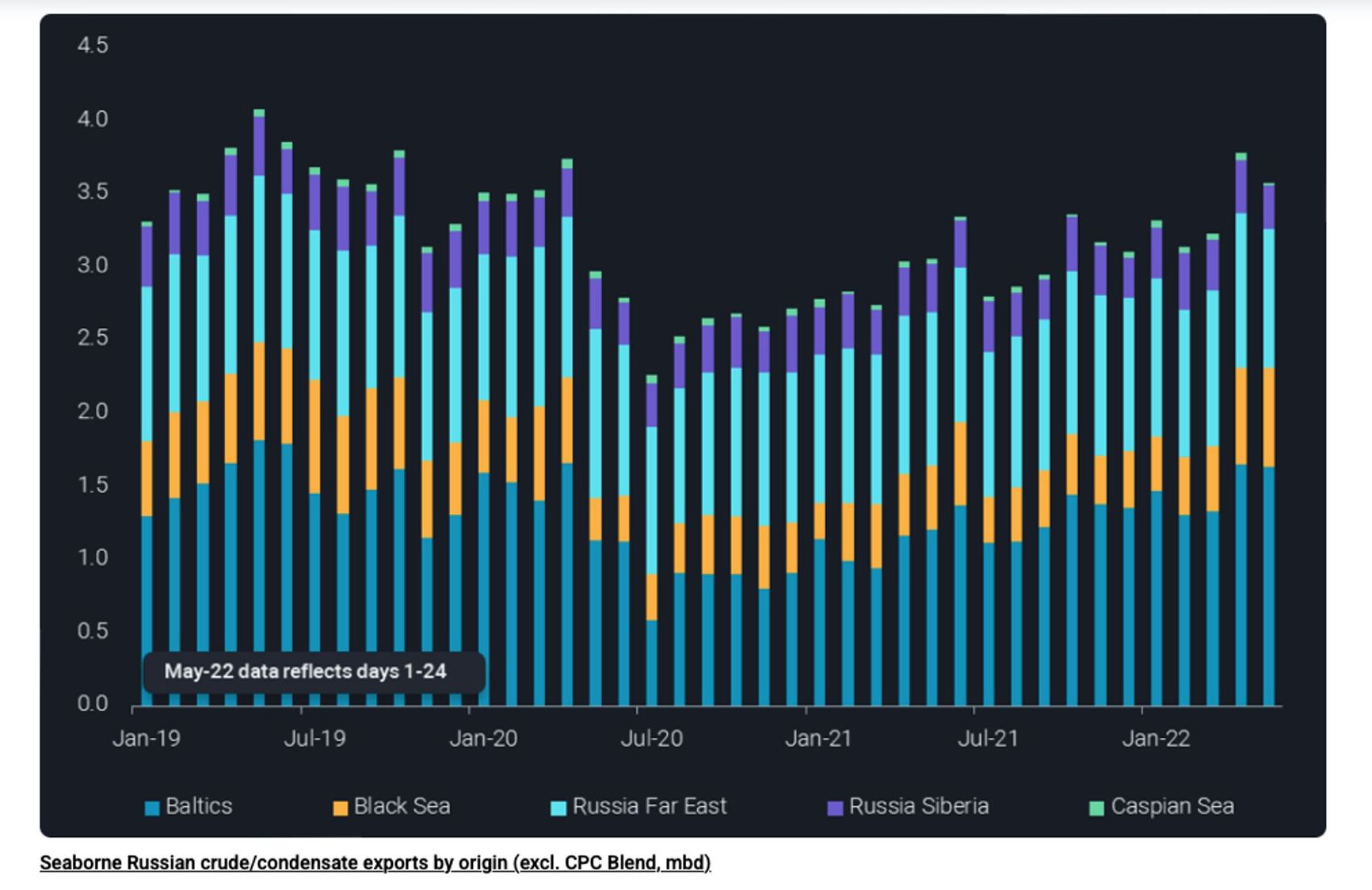

Market players say Russia might even try to increase the throughput capacity of the East Siberia-Pacific Ocean oil pipeline, which transports raw materials to Asia, particularly to China. This could be done with the help of additives, substances added in small quantities to fuel to improve its performance properties. According to the estimates of the analytical agency Vortexa the supplies via this route may increase by 100,000-200,000 barrels per day.

Oil exports through the Far Eastern port of Kozmino, where another branch of the pipeline ends, have also been steadily increasing in recent months, rising to 900,000 bpd in June - although they were below 700,000 bpd before the war in Ukraine began.

Oil shipment destinations from Russia by region https://www.rystadenergy.com/newsevents/news/press-releases/Asia-imports-more-seaborne-Russian-oil-than-Europe-with-India-taking-the-lion-share-of-Urals/

The Russian Transport Minister recently spoke about plans for conducting dredging operations in Makhachkala, Astrakhan and Olya ports. Until recently this direction was not in demand among Russian companies, but in spring two shipments of oil were dispatched from Makhachkala. Usually the port is used to transship transit oil from Kazakhstan and Turkmenistan, which is then piped to Novorossiysk for further shipment. Now Russia is counting on the establishment of intra-Caspian routes, in particular, on transit deliveries of raw materials through Iranian territory to India.

The trading companies that buy and sell Russian oil and oil products have been opening offices in the Middle East in large numbers - for example, in Dubai - in an attempt to evade European sanctions.

Covering tracks

Traders in private conversations report the emergence of new trading companies that are lengthening the resale chain of raw materials and petroleum products. They also engage in intermediate transshipment and mix several grades in one tanker, thereby “clearing” the commodity of risks and toxicity. This is basically what is meant by re-exporting Russian oil.

Data from ship trackers say that crude from Russia gets transshipped from tanker to tanker off the Azores and then sent in giant VLCC-sized ships to Asia. Such shipments could be of interest to Asian buyers who want to comply with sanctions on Russia and simultaneously continue to buy raw materials at a reasonable price. A similar setup is used to transship Russian oil from Gibraltar, less frequently from Greece and Malta.

Traders report the emergence of new trading companies that are lengthening the resale chain of raw materials and oil products

But this arrangement is likely to be fully or partially curtailed when the embargo comes into effect in December - unless traders learn a different method of concealing the origin of Russian oil. In early July the European Commission provided clarifications on the embargo on Russian oil, according to which the ban will also apply to blends (mixtures of several grades).

At the same time the restrictions will not affect oil products made from Russian raw materials. In this situation the countries which refine crude from Russia will continue to receive their high margins based on the low cost of “toxic” raw materials and the high price of diesel fuel, for the production of which Urals is ideally suited.

On a separate note, we observe another arrangement: a country, which is also an energy exporter, buys Russian oil or oil products at a discount and at the same time increases the export of its own oil to Europe. That is how countries in the Middle East can operate, using fuel oil for power generation, especially during the hot months.

A breach in the sanctions

Experts and politicians are concerned that the planned EU sanctions do not completely block European companies from interacting with Russian oil. For example, shipping companies from Greece, Malta and Cyprus, on the contrary, have increased the transportation volume of raw materials from Russia and will be able to continue delivering such shipments to third countries even after the embargo takes effect, as such activity is not restricted by the sanctions.

Shipping companies from Greece, Malta and Cyprus have increased the volume of transportation of raw materials from Russia

“If the shipping companies also fall under sanctions, the entire Greek fleet will change its flag,” joked one of the interviewed traders.

However, according to him, even today, with the restrictions of the “sixth package” are yet to be introduced, the market feels serious pressure from European regulators, since the sanctions have touched shipping insurance, and therefore European insurers are already refusing to work with Russian cargoes. Yet, the trader admits that so far, the transportation of Russian oil has only meant additional work for trading companies’ employees, but it does not seem to be an impossible task.

Market players name the lack of letters of credit to finance the deals, the growing insurance costs (Russian ports are seen by insurers as a war zone), and the collapse of the insurance market (in the European region it is still possible to insure a tanker in Great Britain, but such a possibility will soon disappear) among the difficulties which have already arisen in connection with the sale of Russian oil.

Most of the shippers’ insurance market falls under the jurisdiction of the EU. And even though there are alternatives on small insurance markets in India, China and Russia, the restrictions will affect the tanker market. According to a Vortexa study, new ways to prevent the transportation routes of raw materials or tanker port calls from being tracked are emerging in the insurance sector amid sanctions, and ships that used to deliver raw materials from Iran and Venezuela are becoming to be involved in Russian oil shipments.

Budget Losses

If production and export volumes from Russia continue at their current levels, the Russian economy will not feel any serious discomfort in the short term.

Russian budget losses from the embargo are still more of a theoretical question, and the answer depends on what to recognize as losses. For example, according to Bloomberg analysts' calculations the loss will amount to about $22 billion, consisting of the discount to the Brent oil benchmark at which Russian companies will have to sell their oil to Asia ($10 billion) and the “losses” from stopping supplies to Poland and Germany via the northern branch of the Druzhba pipeline (another $12 billion). In their calculations the analysts proceeded from the 2021 export volumes and the average price of Urals crude of $85 per barrel.

According to Bloomberg calculations, Russia's budget losses will amount to about $22 billion

Yet, today, in real life, Russia is not losing, but gaining. Bloomberg also noted that amid high world energy prices, revenues in the Russian oil and gas sector might reach a record $285 billion in 2022. Of course, this situation is significantly influenced by gas prices, but so far everything is looking good for Russia on the oil market. The average oil price since Russia invaded Ukraine has been $111 per barrel, compared to $89 per barrel before the war. Even taking into account that a fairly large portion of Russian crude is subject to a discount to Brent of approximately $34 a barrel, the selling price of Russian oil exceeds $70 a barrel with a production cost of $15-45 a barrel, depending on the complexity of the project.

As of today, Russia is not losing but gaining

Despite the fact that Russian crude supplies abroad have shrank by 250,000 bpd to 7.4 million bpd, revenues stood at $20.4 billion last month, according to the International Energy Agency (IEA), a $700 million increase due to higher oil prices. That's 40% higher than last year's average. Given the unprecedented strengthening of the Russian currency, budget ruble revenues decreased by 18% in one month, but this change may rather be called technical.

The idea of a “price cap” proposed at the G7 summit is also not ideal for Russia, as long as Russia still has the key lever to put pressure on the market - export volumes. Energy consumption grows every year, and any reduction can have a strong impact on the market. This year, global consumption should return to pre-covid levels and increase by 3.36 million barrels per day compared to last year, according to the latest OPEC forecast.

Russia's seaborne oil exports remain at high levels https://www.vortexa.com/insights/crude/russian-crude-in-transit-at-record-highs/

During the 1973 oil crisis, a 5% reduction in global supply led to a threefold increase in prices. Analysts at JPMorgan estimated that if Russia cuts production by 3 million bpd, the price will jump to $190, and if production is cut by 5 million bpd the price will go up to $380. Since the beginning of the year, Russia's production level has been fluctuating around 10-11 million bpd.

It is worth noting that a cut in production will not remain without consequences for Russia itself: if wells are mothballed, the restoration of production will require investments several times higher than what companies will spend on mothballing.

Delayed effect

Judging by the results of the first months, the sanctions and the oil embargo will not make Russia stop the war in Ukraine either today or tomorrow. And even if Western countries manage to somehow reduce the flow of foreign exchange earnings from Russian energy companies, so far the Russian army has been using already available resources.

But in the long run, the sanctions could have disastrous consequences for the Russian oil industry because of the technologies, materials, spare parts, and licenses that are so needed in this competitive market. Company employees have already been complaining about certain characteristics of Chinese analogues of German spare parts, which require higher frequency of preventive maintenance at oil refineries.

The departure of such global service giants as Schlumberger and Halliburton will obviously be a huge loss for the exploration and production sector: Russian companies simply do not have such expertise. The entire Russian oil strategy of the last few years was based on the increase in the share of development of hard-to-recover reserves.

The situation is such that the share of conventional reserves not requiring high technology in their development is decreasing every year. And if Russian companies are not able to somehow obtain the necessary expertise, the country’s oil production will start to decline naturally.